Table of Content

A mortgage credit certificate is a dollar-for-dollar tax credit that reduces the amount a homeowner owes on their annual federal taxes. MCCs can reduce a borrower’s tax bill by up to $2,000 each year. These are often built into first-time home buyer loan programs offered by state HFAs. A few mortgage lenders offer home loans for buyers in specific professions. These are often for public servants like teachers, doctors, nurses, firefighters, and other first responders.

Anytime you take out a home loan, you’ll want to be aware of the closing costs. Closing costs can be anywhere between 3-6% of the loan amount, and include fees such as loan origination charges, prepaid interest and property taxes. Choosing a higher interest rate in exchange for lender credit can reduce your upfront costs. The strategy can save you money in the short-term, so it’s worth considering if you plan to sell or refinance your home within five to eight years.

Loan Terms

For fixed and tracker rate mortgages, when the specified period expires, the rate will revert to the HSBC Standard Variable Rate/Buy-to-let Variable Rate. The Neighborhood Assistance Corporation of America is another nationwide nonprofit that can help you buy a home. NACA offers financially unstable households mortgage counseling and education. NACAs team members also help low-income families find lenders willing to work with them. Lenders usually dont want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance. For example, if your total monthly income is $7,000, then your housing payment shouldnt be more than $2,170 to $2,520.

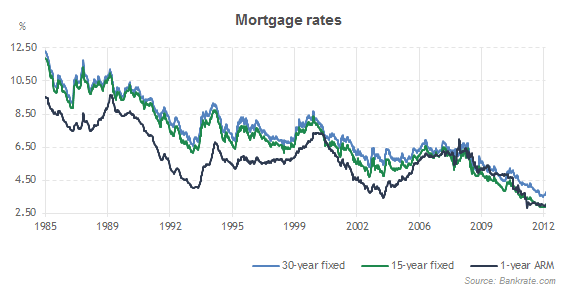

The Federal Reserve adjusts the federal funds rate as part of its effort to control inflation. The state where you're buying your home could influence your interest rate. Here's the average interest rate by loan type in each state according to data from S&P Global. According to FICO, only people with credit scores above 660 will truly see interest rates around the national average. If you are in the market to buy a home in North Carolina, you have probably heard that interest rates are going up.

First-time home buyers guide: Key takeaways

To give some perspective, mortgage rates previously hit their low in 2010 when they dropped to 3.41%. A fixed-rate mortgage means that your payments will stay the same until the end date of the fixed-rate period, even if interest rates change. Your lender will be able to provide you with a line-item breakdown of your mortgage payment. Using a mortgage calculator is an easy way to find out what your monthly payments will be. You can also look at an amortization schedule, which shows you how much you’ll pay over time. Once you find a rate that is an ideal fit for your budget, it’s best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase.

In terms of mortgage affordability, the VA loan is hard to beat if you’re eligible. Conventional conforming mortgage loans are what most home buyers think of when they think of home loans. The term “conforming” means these loans meet guidelines established by Fannie Mae and Freddie Mac. Conforming mortgages are often the best choice for home buyers with good credit scores and a down payment of at least 10%. Your goal as a mortgage borrower should be to find the lowest interest rate possible. This will keep your monthly mortgage payments affordable, and reduce the amount of interest you pay your lender over the life of the loan.

Summary Of Current Mortgage Rates

The scheme provides an equity loan to top up your deposit, which means you borrow money less money from the mortgage lender. The most recent UK Finance data shows that there were just over 80,000 mortgages in arrears in the third quarter of this year, which was almost unchanged on the previous three-month period. However, the number of homeowner-mortgaged properties repossessed was up almost 15% on the previous quarter. While rate rises are not great for mortgages, savings rates could rise too. To get the best mortgage interest rate for your situation, it’s best to shop around with multiple lenders. Mortgage rates have been pushed up primarily by the highest inflation in four decades.

Mortgage repayment calculators can give you an idea of what your monthly payments will be. Compare these estimated payments with your current monthly outgoings to see if you can afford them. Some lenders offer guarantor mortgages, where a friend or family member promises to step in and meet the mortgage repayments if you’re unable to.

Savings accounts

For example, if your total monthly income is $7,000, then your housing payment shouldn’t be more than $2,170 to $2,520. This three-page standardized document will show you the loan’s interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years. Borrowers have no control over the wider economy, but they can control their own financial picture to get the best rate available. Typically, borrowers with higher FICO scores, lower debt-to-income ratios and a larger down payment can lock in lower rates.

This was at its highest in 2009 when 47% of home buyers were purchasing for the first time. 2017 figures show the lowest proportion of first-time buyers in the market at 29%, however, the year also saw the highest number of overall home buyers since 2006 . The data below shows how the pandemic has affected home prices for first-time buyers. Six in ten (60%) unmarried couples who are purchasing homes are first-time buyers. This figure is dramatically lower for home-buying Americans who are married with children - only 32% of this group are purchasing their first home.

Keep in mind that lenders generally reserve the lowest interest rates for borrowers with strong credit profiles, including FICO scores in the mid 700s. Before you decide to refinance, be sure to go over the cost of refinancing with the potential savings to see if it makes financial sense. The average rate on a 30-year fixed-rate mortgagehas remained below 3% since July 30, dipping down to an all-time low of 2.88% in early August.

When buying a home, the bigger your deposit, the better your interest rate will be. If you're buying a property in the UK, you may have to pay some form of Stamp Duty. To increase your borrowing potential, it's a good idea to start spending sensibly and reduce your outgoings three to six months before you apply.

Fannie Mae predicts $2.72 trillion in mortgage originations in 2021 and $2.47 trillion in 2022. They anticipate purchase volume to go from $1.53 trillion in 2020 to $1.6 trillion in 2021 and $1.64 trillion in 2022. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. And of course, if you have a larger down payment, it will help you in all these factors for affording a home. You’ll be expected to provide recent pay stubs, often the last two pay periods, that indicate how much you make and prove employment.

And means a parent, guardian or close relative agrees to be responsible for paying the mortgage if you can’t. Saving more than 5% will give you access to a wider range of cheaper mortgages available on the market. If you want to come out of your fixed-rate early, then you may be charged exit fees by your lender.

What’s considered a good credit score for a mortgage?

If you’re ready to get serious about buying a house, talk to a mortgage advisor about your first-time home buyer loan options. There’s a wide range of programs available and it’s important to find the loan that best meets your needs. This will make it easier to qualify and should reduce your mortgage costs, too.

It’s been gaining traction since the start of the pandemic, and the housing market is a prime example of this. By refinancing an existing loan, the total finance charges incurred may be higher over the life of the loan. A 5/1 ARM has an average rate of 5.50%, which is a climb of 3 basis points from seven days ago.

No comments:

Post a Comment